Buying a Vineyard Estate in the Loire Valley: A Sound Investment in Wine

Summarise this article with :

The French wine market is undergoing profound transformations. Climate challenges, the rise of organic wines, and shifting consumer habits are reshaping the industry, creating new opportunities for investors and wine enthusiasts alike.

Within this changing landscape, the Loire Valley stands out as a region of strong potential. As France’s fourth-largest vineyard area, it captivates with the diversity of its terroirs, the growing reputation of its appellations, and the vitality of its wine tourism.

Balancing accessibility and prestige, the Loire attracts a wide range of profiles: investors, career changers, and professionals from the sector seeking to establish themselves.

But is purchasing a vineyard estate truly a safe investment? Straddling passion and economic strategy, this venture requires careful consideration and professional guidance.

Why Invest in Vineyards: An Investment Between Passion and Strategy

Investing in vineyards is far more than a simple land purchase. It is a unique investment at the crossroads of passion and long-term wealth strategy. Beyond the dream it represents, vineyard ownership is rooted in concrete economic and structural realities that must be clearly understood.

A Tangible, Heritage-Driven Investment

In an economic context where financial markets remain volatile and often unpredictable, vineyard land continues to stand as a safe haven. Unlike other types of assets, vineyard real estate offers long-term stability, with a gradual appreciation in value, especially in renowned appellations.

Acquiring vines allows investors to:

- Secure their capital through a tangible asset that weathers economic crises better than many traditional investments.

- Diversify their portfolio by entering a thriving agri-food sector.

- Benefit from mid- to long-term capital appreciation, particularly in regions where appellation recognition is on the rise.

Profitability: Possible, Yet Demanding

While investing in vineyards offers strong potential for wealth building, the profitability of a wine estate depends on multiple factors. It is important to distinguish between several models:

- Land-only investment: the investor acquires vineyard plots and leases them out under a viticultural lease (bail rural viticole). This model provides rental income while benefiting from land appreciation.

- Operating a vineyard estate: this option involves managing both wine production and sales, a demanding profession requiring technical expertise, commercial skills, and rigorous cost management.

- Partnership with a winegrower: here, the investor provides financial or commercial support while the winemaker takes charge of vineyard management and winemaking.

The profitability of a wine estate also depends on several key factors:

- Size of the estate and appellation: renowned vineyards tend to generate higher value but require a more substantial initial investment.

- Sales and distribution model: whether through direct sales, short supply chains, or exports, the chosen approach plays a decisive role in profitability.

- Climate risks and production costs: managing threats such as hail, frost, or drought is a crucial element to anticipate.

Therefore, investing in vineyards should not be viewed as a source of immediate returns. But rather as a medium- to long-term project where patience and strategic planning are essential.

The Loire Valley: An Exceptional Terroir with Strong Potential

A Historic and Renowned Vineyard

With its landscapes dotted with castles and rivers, the Loire Valley embodies the elegance and heritage of French winemaking. As the country’s fourth-largest wine region, covering over 58,000 hectares, it brings together a mosaic of terroirs that define the unique identity of its wines. This diversity, unmatched in France, makes the Loire one of the most dynamic and attractive wine regions, both for enthusiasts and for investors.

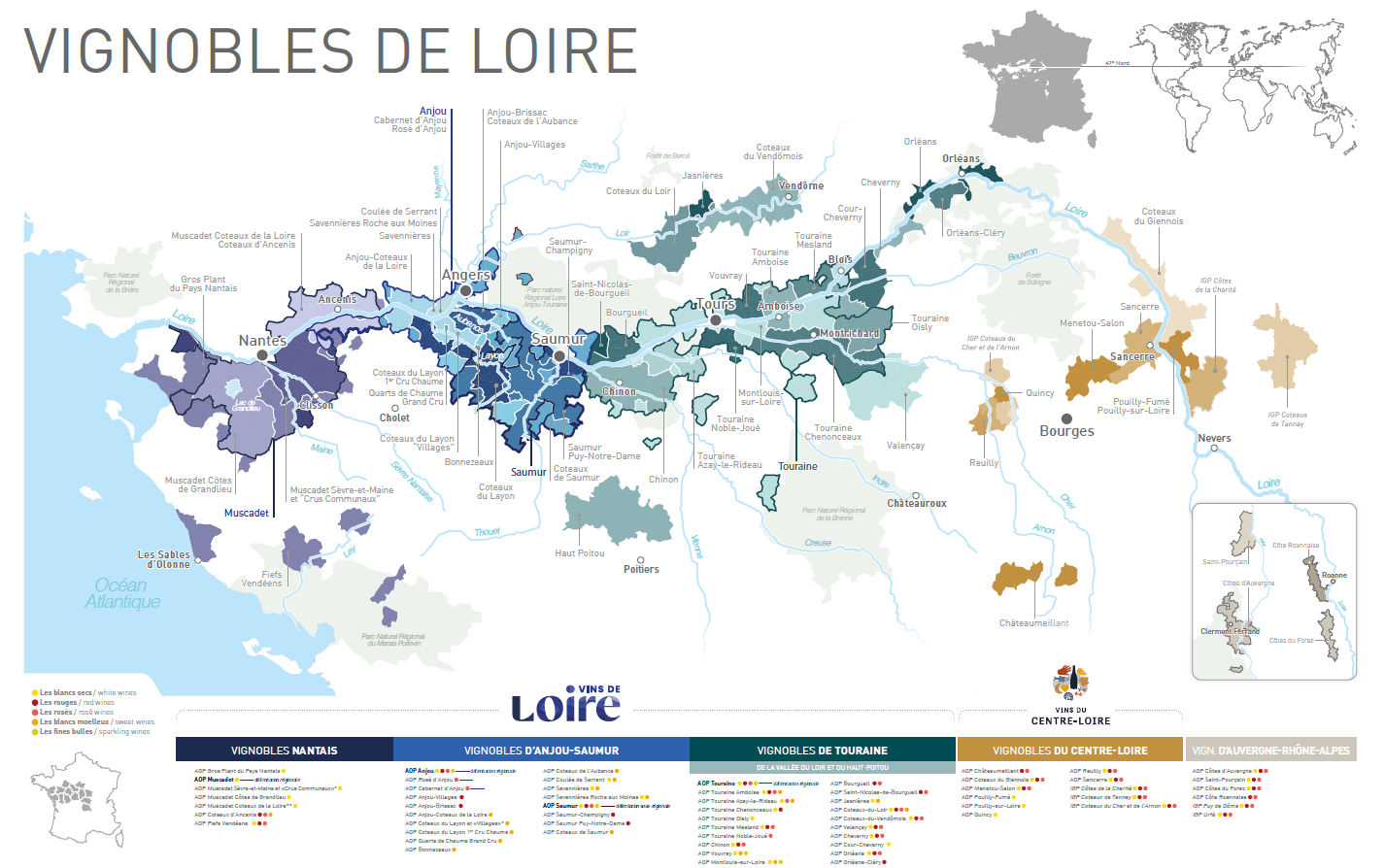

Home to more than 50 appellations d’origine contrôlée (AOC), the Loire offers an unparalleled variety of styles: crisp and aromatic whites, elegant and fruity reds, refreshing rosés, as well as outstanding sparkling and sweet wines. This wealth of expression is made possible by the diversity of its climates and soils, supporting a constantly evolving and multifaceted production.

Among the appellations currently gaining recognition, several stand out on both the national and international scene. Sancerre continues to expand thanks to the consistently high quality of its wines. Vouvray, renowned for its Chenin Blanc, is distinguished by its ability to produce both sparkling wines and long-lived sweet wines. Meanwhile, Chinon has become a benchmark for lovers of refined, elegant Cabernet Franc, celebrated for its remarkable freshness.

Learn more about why the Loire Valley is an excellent choice for vineyard investors

A Competitive Price-to-Quality Ratio Compared to Major Wine Regions

One of the Loire Valley’s greatest strengths lies in its particularly attractive price-to-quality ratio. Especially when compared with others French wine regions such as Bourgogne or Bordeaux, where land and wine prices can reach extraordinary levels.

This relative affordability makes the Loire an appealing alternative for investors and new winegrowers, who can establish themselves more easily while benefiting from a dynamic market.

One of the Loire Valley’s greatest strengths lies in the price of its vineyard land, which remains far more accessible than in other prestigious regions. For comparison, here is an overview of vineyard land prices by region:

| Region | Appellations | Price per hectare | Comments |

|---|---|---|---|

| Bourgogne | Côte-d’Or (Vosne-Romanée, Gevrey-Chambertin) | Several million euros | Very high prestige, world-renowned |

| Bordeaux | Médoc, Saint-Émilion (crus classés) | > 500 000 € | Variation depending on the reputation of the cru |

| Loire Valley | Muscadet, Anjou, Saumur, Touraine, Centre-Loire | Entre 12 000 € et 300 000 € | Attractive prices, diverse terroirs |

This cost difference makes it easier for aspiring winemakers to acquire an estate without requiring an exorbitant initial capital. Operating costs are also generally more manageable than in Bourgogne or Bordeaux, where the demand for highly specialized labor and heavy investments in cellars can weigh heavily on budgets.

For a complete overview of current market trends, read our full guide on French vineyard prices in 2025

A Market in Full Transformation

Consumer habits have shifted dramatically in recent years. While powerful, oaky wines once dominated the market, a strong trend has emerged in favor of fresher white wines and lighter reds. Today, freshness and finesse have become key criteria in wine selection.

The Loire Valley, historically renowned for its vibrant and aromatic whites (Sancerre, Muscadet, Vouvray, Anjou, Pouilly-Fumé…) and its light, fruit-forward reds (Chinon, Saumur, Saint-Nicolas-de-Bourgueil), is perfectly aligned with this evolution. Its wines embody the balance and elegance sought by today’s consumers.

At the same time, the region is fully engaged in the rise of organic and natural wines, meeting the growing ecological concerns of the market. The Loire Valley is now one of France’s most dynamic regions for organic conversion. According to a 2023 study by Techniloire, 85% of Loire vineyards and 73% of estates are committed to environmental certifications, including organic agriculture and other recognized sustainability initiatives.

This commitment to more sustainable viticulture significantly enhances the region’s appeal, particularly among younger generations and international markets.

A Growing Enthusiasm for Wine Tourism

Another key factor in the Loire Valley’s vitality is the development of wine tourism. Classified as a UNESCO World Heritage site, the region benefits from an exceptional setting that attracts thousands of visitors each year.

For winegrowers, wine tourism represents a genuine economic opportunity, allowing them to:

- Diversify their sources of income by developing direct sales and wine-related experiences.

- Increase the visibility and reputation of their estates and appellations by offering immersive, educational visits.

- Build loyalty among both local and international clients, who are eager to combine cultural heritage with memorable tasting experiences.

Thanks to this positive momentum, the Loire Valley is asserting itself as a vineyard of the future, where tradition and innovation come together to meet evolving market expectations. Investing in a wine estate in the region therefore means not only entering a sector in full transformation but also seizing an opportunity with high potential

The Challenges and Keys to Success for Such a Project

Investing in a vineyard estate is an ambitious undertaking that requires a strategic approach and a solid understanding of the sector’s economic and technical realities.

A thorough analysis of the business model is essential to assess profitability: direct sales, exports, distribution through wine merchants, or even diversification via wine tourism—each option comes with its own opportunities and constraints.

One of the major challenges remains risk management, particularly climate-related risks, which are becoming increasingly severe. Frost, hail, and drought require significant investments in protective measures and insurance coverage.

To ensure long-term sustainability, guidance from experts is indispensable. Vineyard transaction specialists, financial advisors, notaries, specialized lawyers, and accountants all play a crucial role in securing acquisitions and optimizing financial structures.

In today’s context of premiumization and evolving consumer expectations, the Loire Valley offers genuine opportunities to investors: provided they adopt a thoughtful and disciplined approach.

Conclusion: Turning Ambition into Reality

The Loire Valley is positioning itself as a vineyard of the future, where tradition and modernity combine to create an ideal setting for investors and winegrowers.

Its accessible land prices, potential for appreciation, and the steady growth of its market make it a particularly attractive region for those looking to embark on a sustainable and profitable wine project.

However, investing in a vineyard estate is not something to be improvised. Whether driven by a desire to build long-term wealth or to settle into winegrowing, every project requires tailored guidance.

At Ampelio, we bring our expertise of the Loire Valley wine market to future buyers. With a deep understanding of land, economic, and strategic considerations, we support you at every step of your acquisition.

Purchasing a vineyard estate in the Loire Valley is both an exciting and demanding journey. With the right support, it can become a genuine success—both financially and personally.

Ampelio is by your side to transform your ambition into a concrete and lasting wine project.

Find Your Vineyard Estate in the Loire Valley

At Ampelio, our mission is to create the right match between a wine estate and its future owner. We place people at the very heart of our work.

In every transfer, our main concern is ensuring that the association is lasting, sustainable, and balanced — so that each party can thrive and find value in the project. The economic future of the wine estate is also a key element we take into account.

We actively support these transitions and dedicate all our expertise to serving each project.

Do you have a question about selling or buying a wine estate?

Our team will be delighted to discuss your project with you and answer all your questions.

Ampelio brings over 10 years of experience in supporting and advising on wine estate transactions in the Loire Valley.