Vineyard Transfer: How to Manage Stock Takeover Effectively

Summarise this article with :

You’ve defined your specifications, built your vineyard project, studied various estates, and carried out visits. Finally, you have set your sights on a particular estate and are ready to make an offer.

When preparing the business forecast, one essential question arises: do you wish to take over the wine stocks from the previous owners? And if so, to what extent?

This is a crucial aspect of the forecast, as it can also shape your future role as the estate’s new manager and impact the current winegrowers.

For your information, all our files are presented with both the stock value and the advances on crops, since, as explained in this article, these values evolve on a daily basis.

Here’s everything you need to know about taking over stocks during the transfer of a vineyard estate.

What Is Included in the Stocks?

Taking over the stocks of a vineyard estate involves several key elements:

According to Article 211-7 of the French General Accounting Plan (PCG), “a stock is an asset held for sale in the normal course of business, in the process of being produced for such a sale, or intended to be consumed in the production process.”

In practical terms, stocks therefore include:

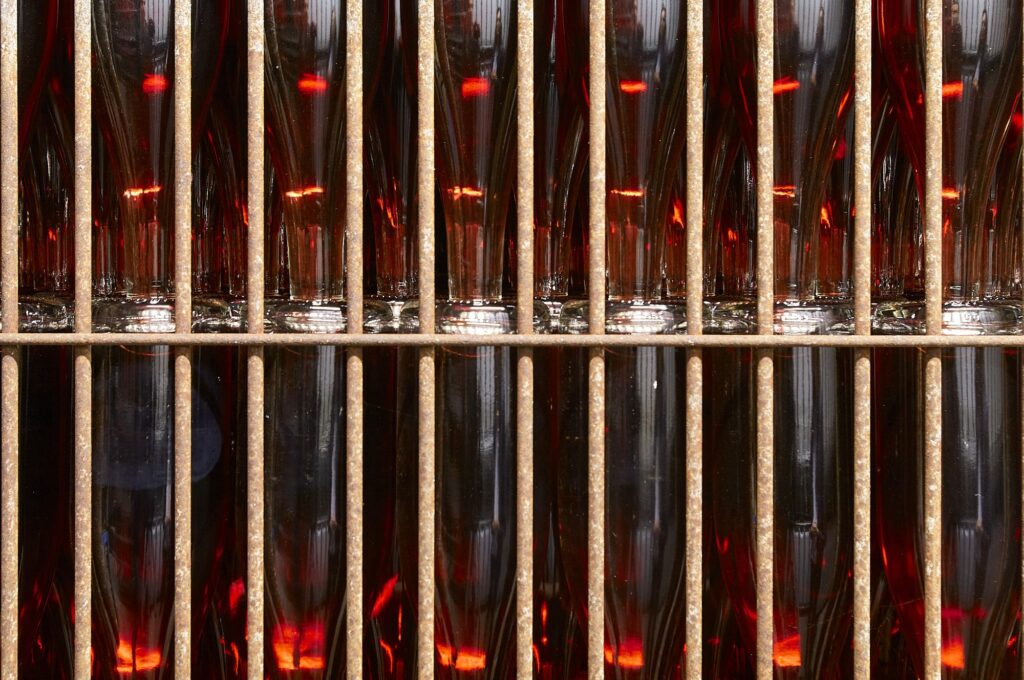

- Finished products: bottles from recent vintages that have been kept, whether for commercial purposes or not.

- Work in progress: wine still in tanks, currently undergoing vinification, which will soon be bottled.

- Dry goods: labels, bottles, corks, cartons, etc.

- Advances on crops.

Stocks are considered active elements, constantly changing over time. They will therefore never be identical between the initial sale listing, the signed offer, and the final transfer.

And since they evolve on a daily basis, their value does as well.

💡 A note on advances on crops: although the topic may seem straightforward, it is in fact complex. Discussions are often challenging, as different methods are used. Feel free to contact us with any questions you may have.

How Are Stocks Valued?

Stocks must be assessed every year. They are required not only for the balance sheet but also for customs declarations.

This evaluation is carried out by the accountants dedicated to the estate, who must always address the following questions:

- Tax value or accounting value?

- Valuation based on market price or cost price?

In most cases, negotiations between sellers and buyers result in using the balance sheet value. However, in certain transactions, a revaluation may be considered depending on the quality of the wines and the track record of specific vintages or terroirs.

A tasting of all stocks is highly recommended in order to ensure the takeover of a “fair and marketable stock.”

When and How Are Stocks Determined?

As mentioned earlier, stocks are valued once a year at the time of the financial year-end closing.

For preparing the business forecast and the purchase offer, we recommend relying on the value from the most recent balance sheet. You may also request that this value be clarified by the winegrowers or their accountants: how many bottles, which wines, which vintages, and how the wines in tanks will be allocated.

A few days before the final transfer of the estate, we conduct a full inventory together with all parties involved, covering stocks (wines and dry goods) as well as equipment.

Advances on crops are dealt with beforehand between advisors.

When and How to Negotiate the Takeover of Stocks?

First of all, it is important to note that, legally, there is no obligation to take over the stocks of a company being acquired. The choice rests entirely with the buyer.

Stocks are therefore subject to negotiation and must lead to an agreement between seller and buyer.

Possible scenarios include:

- Total takeover: with payment made either in full or through a seller’s credit.

- Partial takeover: for example, only the most recent vintage, the upcoming harvest, or stocks already committed to a market.

- No takeover: the seller keeps the stocks and continues sales activity for several more years.

The Advantages of Taking Over Stocks

When you acquire a vineyard estate, you have not yet produced your own wine, regardless of the time of year the transfer takes place.

Taking over existing wines allows you to continue commercial activity right away, well before you can sell the wine from your own production.

This also strengthens your cash flow projections.

The Drawbacks of Taking Over Stocks

Depending on the volume of stock available, the assessed amount can significantly impact both your financial forecast and the final purchase price.

You should also consider whether taking over the entire stock truly aligns with your established commercial strategy.

It is therefore essential to study this matter carefully with your advisors (Ampelio, accountant, notary, lawyer). Find out which advisors you should rely on during a vineyard transfer

To what extent should you take over the stocks, both in terms of your budget and your ability to sell these bottles and/or process the bulk wine.

Conclusion

Acquiring a vineyard estate means taking over assets, living elements, that are constantly evolving.

Just as a winegrower tends to the vines, which change throughout the year and face the uncertainties of nature, each estate is unique, with its own characteristics, strengths, and challenges.

Each buyer is also unique, with their own aspirations and projects.

Our main mission is to adapt, to listen, and to create a common synergy between seller and buyer, for the benefit of the vineyard estate itself.

At Ampelio, our vocation is to find the right match between a vineyard estate and its new owner. We place people and the living world at the very heart of our work. Discover the values that guide us every day.

At Ampelio, our mission is to create the right match between a wine estate and its future owner. We place people at the very heart of our work.

In every transfer, our main concern is ensuring that the association is lasting, sustainable, and balanced — so that each party can thrive and find value in the project. The economic future of the wine estate is also a key element we take into account.

We actively support these transitions and dedicate all our expertise to serving each project.

Do you have a question about selling or buying a wine estate?

Our team will be delighted to discuss your project with you and answer all your questions.

Ampelio brings over 10 years of experience in supporting and advising on wine estate transactions in the Loire Valley.