Vineyard Acquisition Process for First-Time Buyers (1/2) – Buyer Profiles

Summarise this article with :

A vineyard is a business like any other, and any acquisition should be considered as the purchase of a traditional company. For this reason, taking over a wine estate must be approached and evaluated according to a series of objective, measurable criteria.

How to take over a vineyard?

Acquiring a vineyard involves purchasing the vineyard’s hectares of vines, farm buildings, winemaking equipment and cellars, wine stocks, human resources, and often existing companies. To ensure success, it is essential to be properly advised and accompanied throughout the process.

Learn more about the professionals who can guide you throughout the process in Vineyard Transfer: Which Advisors Should You Rely On?.

In such a project, while passion is undeniably important, it should never overshadow reason. A thorough analysis of all the vineyard’s parameters, and particularly the business itself, is indispensable.

The vineyard is a living heritage. If left unattended for several months, it becomes difficult, if not impossible, to restore it to a productive state. Buying a wine estate is therefore not simply an investment in land, but an investment in a living, fundamental element at the heart of your project.

To better understand how such a project can combine personal fulfillment with long-term financial value, explore our article Buying a Vineyard Estate in the Loire Valley: A Sound Investment in Wine.

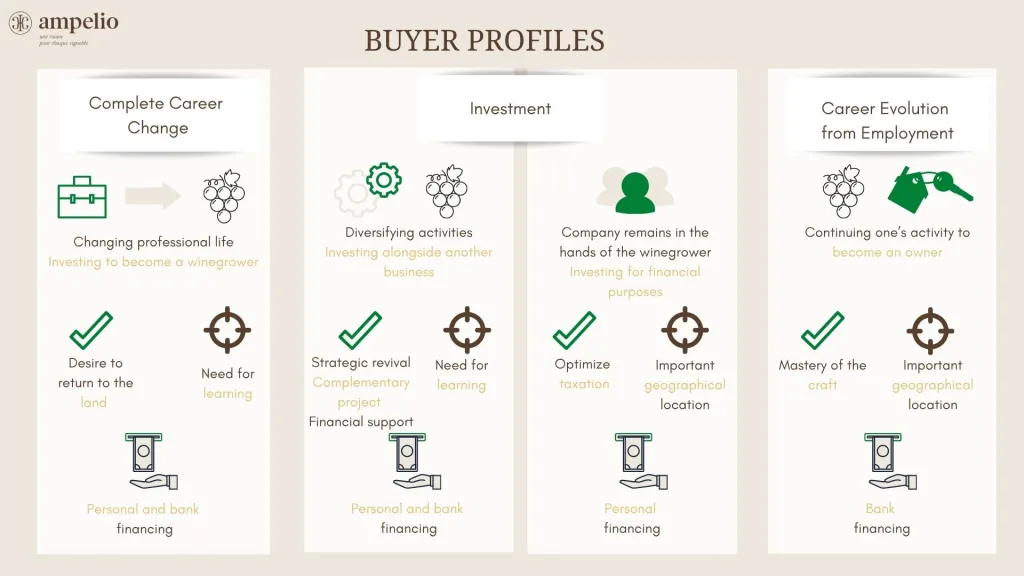

From our experience, vineyard acquisition projects are as diverse as they are unique. Each buyer profile comes with its own vision, and each must be carefully considered on its own merits.

The complete career change

For some, viticulture represents an opportunity to start an entirely new life. In this scenario, the buyer chooses to leave their professional career behind to fully commit to the winegrowing sector. More often than not, this person is both passionate and a skilled manager, previously at the head of a company in industry or the service sector.

Two main motivations are frequently cited: a deep desire to reconnect with the land, and the wish to step away from a stressful environment to embrace an activity closely tied to nature and the living world. Beyond that, the buyer is also seeking greater personal fulfillment through this new venture.

In most cases, this type of project is funded with the buyer’s own capital, often from the sale of their previous business or personal assets. The main challenge, however, will lie in learning the technical skills specific to running a vineyard.

The vineyard as an investment

This option is often chosen by individuals who combine personal capital with a passion for wine. For them, the vineyard is seen as a secondary activity, and sometimes as a purely financial investment. Their main concern is therefore focused on the project itself rather than on strict accounting considerations.

Within this category, we can distinguish two types of profiles:

and those who prefer to purchase a profitable vineyard already running smoothly, entrusting its management to a vineyard manager.

those who choose to acquire a struggling estate and invest in reviving it,

a) Investing to Become a Winegrower

“I’m 60 years old, I already run a business, and as a wine enthusiast I want to invest… My company is doing very well, and I would like to put my experience to work for a wine estate.”

This type of investor is looking to diversify their activities and optimize their tax strategy, which means they will be searching for the estate that best matches their expectations. With strong management experience, they will take a critical look at the company’s liabilities and aim to implement a new development strategy.

Over time, viticulture and the profession of winemaker will become their primary activity, from which they will expect at least a minimum income. As a result, the geographical location of the vineyard is a crucial factor, since they often need to balance time between two workplaces.

b) Investing for Financial Purposes

In this case as well, we are dealing with an investor with substantial personal capital. Their passion for wine and land drives them to invest in viticulture, even if they openly admit they lack technical knowledge and have no intention of changing careers to become a winemaker.

What they seek is a vineyard where they can make the key strategic decisions, perhaps introduce a new dynamic with an innovative approach, while entrusting day-to-day management to qualified professionals.

From this investment model, one possible arrangement is that the investor acquires the land, while the operating company remains in the hands of professionals. In parallel, the winegrowers may hold or even retain a majority stake in the operating company. The investor then benefits from a financial return through rental income (fermages) and serves as a solid financial backer, without being involved in the daily decision-making.

Because vineyards are a secure investment, this represents a steadily growing alternative asset.

Before taking the leap, it’s important to estimate your total investment and understand what drives vineyard prices. For a full breakdown, see What Budget Do You Need to Buy a Vineyard Estate? Costs, Key Factors & Expert Advice.

A career evolution from employment

An employee with long-standing professional experience may one day feel the desire to become a vineyard owner. In such cases, motivations can be varied: the search for independence, a wish to change daily life, the desire to be involved in every step from the land to sales, or even the plan to partner with a relative or spouse who brings complementary skills to the project. In these situations, the vineyard becomes a true family venture.

This option can sometimes be highly relevant: a professional winegrower already masters the craft, and their willingness to learn more about management, or to benefit from the support of a partner, gives legitimacy to this couple of professionals. However, in such cases, available capital is often limited, and banks are less inclined to provide financing.

When financing is approved, these buyers will most often choose a vineyard within their own region, since they are most comfortable with the local viticultural methods. If bank financing is denied, another model can be applied: a financial investor may step in as a supportive partner, providing crucial backing for these technicians in search of independence.

Before getting started, it’s helpful to understand the typical stages and timeline of such a project. For an overview, read our guide Vineyard Acquisition Timeline: Key Steps to Know.

Conclusion

No matter the buyer’s profile, acquiring a vineyard is always a delicate balance between passion and reason. Both are indispensable. The question remains: what recipe will best suit your project?

Discover the full steps of the vineyard acquisition process with Ampelio.

For more than 10 years, Ampelio has specialized in the sale of vineyards and wine estates in the Loire Valley, assisting both sellers with their transfer projects and buyers with their acquisition plans.

As a trusted partner at every key stage of the process, our team draws on its in-depth knowledge of the wine industry, its networks and stakeholders, as well as its expertise in land, legal, human, and commercial matters.

We support buyers throughout their entire project, addressing every related question—whatever their profile, project scope, requirements, budget, or timeline, all the way to the final signing.

At Ampelio, our mission is to create the right match between a wine estate and its future owner. We place people at the very heart of our work.

In every transfer, our main concern is ensuring that the association is lasting, sustainable, and balanced — so that each party can thrive and find value in the project. The economic future of the wine estate is also a key element we take into account.

We actively support these transitions and dedicate all our expertise to serving each project.

Do you have a question about selling or buying a wine estate?

Our team will be delighted to discuss your project with you and answer all your questions.

Ampelio brings over 10 years of experience in supporting and advising on wine estate transactions in the Loire Valley.