What Budget Do You Need to Buy a Vineyard Estate? Costs, Key Factors & Expert Advice

Summarise this article with :

What Is the Price of a Wine Estate?

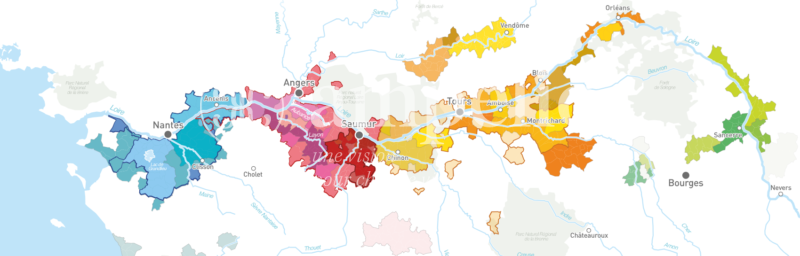

In the Loire Valley, the price of a vineyard estate generally ranges from €500,000 to €5,000,000, including vineyard hectares, farm buildings, and full equipment (cellar and machinery).

However, it is not as straightforward as it seems. There is not one single budget, but rather multiple possible budgets when it comes to acquiring a wine property.

In France, as elsewhere in the world, vineyard estates are plural, unique, and each one is different. There is no such thing as a “standard” wine estate.

That said, it is possible to identify and outline several price ranges.

What Makes Up the Price of a Vineyard Estate

A complete wine estate generally includes:

- vineyards (planted land),

- bare land,

- farm and winery buildings,

- equipment (covering vineyard, winemaking, and cellar machinery),

- staff,

- and in some cases, brands and customer base.

The estate may also include one or more residential houses.

Naturally, the size of the estate has a direct impact on its price. By “size,” we mean the number of vineyard hectares. Mathematically, the more hectares, the higher the cost. The vineyard surface area is also correlated with the size of the buildings: except in a few cases (such as trading-focused operations), more vines mean higher production, which requires more space for winemaking and storage. Again, the more square meters involved, the higher the cost.

Other factors that influence the price include the quality of vineyard maintenance, the age of the buildings and the materials used, as well as the age and performance of the equipment.

Finally, beyond surface area, asset quality, and condition, the estate’s geographical location plays a crucial role in determining its price. Land values vary significantly depending on the appellation areas, ranging from €10,000 to €250,000 per hectare across the Loire Valley.

For a detailed overview of how vineyard prices vary across France you can read our complete guide French Vineyard Prices: What You Need to Know in 2025.

In short, the price of a wine estate is set according to the assets it comprises, based on both quantitative and qualitative criteria.

Beyond the Assets: Additional Costs to Consider

The purchase price of a vineyard estate is not limited to the value of its operating assets. Several additional costs must also be taken into account

Stock and crop advances

The value of stocks and crop advances depends on the time of year when the final transfer is signed. These amounts are determined beforehand in consultation with both parties’ advisors, as different methods can be applied. In the case of a share purchase, the buyer takes over the value of stocks and crop advances based on an accounting statement established at the transfer date. While these amounts can be estimated in advance, their final value is only confirmed once the transaction is complete.

To go further on this topic, discover our detailed guide on best practices for managing stock and crop transfers: Vineyard Transfer: How to Manage Stock Takeover Effectively.

Brokerage commission

It is strongly recommended to seek professional guidance when acquiring a wine estate. The brokerage fee, usually included in the buyer’s offer to the seller, reflects this support: project discussions, dossier presentations, estate visits, assistance with negotiations, and more. Depending on the size of the transaction, brokerage commissions typically range from 4% to 7% before tax.

Notary fees

Notary fees apply in the case of an asset purchase and generally amount to around 6% to 7% of the estate’s total value. If you choose to acquire a company through share purchase, no notary fees are due, but fixed costs will apply depending on the legal structure of the company being transferred.

Company formation costs

If you do not take over existing legal entities, additional costs related to creating new companies must be factored in. These expenses should be assessed with the help of a legal advisor.

For a detailed overview of the experts involved in a vineyard transaction, from legal advisors to notaries and consultants, explore our dedicated article Vineyard Transfer: Which Advisors Should You Rely On?.

The Key Advisors Involved in a Vineyard Estate Transaction

Price Ranges for Vineyard Estates

In the Loire Valley, complete vineyard estates for sale generally fall within a price range of €450,000 to €5 million. There are, of course, exceptions, with some estates priced below €500,000 or above €5 million.

To give a clearer idea of what these budgets represent, here are a few examples of operating assets in good condition, not requiring major reinvestments:

- vineyards in production,

- regularly maintained buildings,

- functional, up-to-date vineyard and winery equipment (including machinery).

Between €700,000 and €800,000.

A vineyard estate with around 20 hectares (€20,000/ha), farm buildings about thirty years old, winery equipment enabling autonomous operations, and a sales distribution split evenly between bulk (to négociants) and direct-to-consumer.

Excluding residential house.

Between €2.5 and €3 million

A vineyard estate with around 20 hectares (€75,000/ha), farm buildings about thirty years old, winery equipment allowing for autonomous operations, and a sales distribution split equally between bulk sales (to négociants) and direct-to-consumer.

Includes a characterful manor house.

Around €500,000

A vineyard estate with around 10 hectares (€20,000/ha), farm buildings about thirty years old, winery equipment for autonomous functioning, and no existing distribution network to take over.

Excluding residential house.

Interested in discovering why the Loire Valley stands out among France’s wine regions? Learn more about its unique advantages and investment potential in our article Advantages and Opportunities of a Vineyard in the Loire Valley.

Financing the Project

When considering the overall budget, it is essential to include the cost of potential investments in buildings, equipment, and vineyards. These amounts are too often overlooked during initial discussions, yet they can significantly influence the total cost of acquisition. Below is a summary of key elements to factor in:

Vineyards

Are there vines to uproot? Bare land ready for planting? Should grape varieties be changed as part of a new strategy?

Buildings

Old does not always mean functional. The quality of maintenance strongly impacts the price. Depending on the estate’s history, you may need to build a new storage facility, reorganize part of the structure, or, conversely, find a new purpose for excessive building space.

Equipment

The market value (different from the book value) reflects real usability. Depending on the buyer’s project, some investments may be necessary, such as acquiring soil-working machinery for organic conversion, while other equipment may no longer be required, for example selling a harvesting machine if outsourcing harvest services is preferred.

Stocks

What level of stock is currently available? Must you take over all of it? If starting without stock, you’ll need to finance the working capital requirement (WCR) to support operations.

Short-Term vs. Long-Term Financing

It is important to distinguish between short-term financing (such as stocks and certain equipment) and long-term financing (investments in buildings or vineyards).

Once your project is sufficiently advanced and you have identified one or more estates, establishing a financial forecast becomes essential. At this stage, consulting with an accounting firm is highly advisable.

In most cases, your personal contribution will determine the overall acquisition budget. If you rely on a bank loan, experience shows that financing will rarely exceed 50% of your own equity contribution, depending on the nature of the project.

Another option to consider is setting up a Groupement Foncier Viticole (GFV – Vineyard Landholding Company). You should also explore potential support from family funds.

Finally, in certain cases, if you are an experienced winemaker with a well-prepared project, AMPELIO may also connect you with investors for a joint installation and land acquisition project.

Conclusion

At Ampelio, our mission is to find the perfect match between a vineyard estate and its future owner. We place people at the very heart of our work.

When facilitating partnerships between young winemakers and investors, our top priority is to ensure that the collaboration is sustainable, balanced, and beneficial for everyone involved. Each party should find fulfillment and mutual interest in the project, while the long-term economic future of the vineyard estate remains secured.

We strongly encourage these opportunities and dedicate all of our expertise and experience to supporting each individual project.

Looking for your future wine estate? Browse our selection of vineyard properties for sale and find the estate that best matches your project and aspirations.

At Ampelio, our mission is to create the right match between a wine estate and its future owner. We place people at the very heart of our work.

In every transfer, our main concern is ensuring that the association is lasting, sustainable, and balanced — so that each party can thrive and find value in the project. The economic future of the wine estate is also a key element we take into account.

We actively support these transitions and dedicate all our expertise to serving each project.

Do you have a question about selling or buying a wine estate?

Our team will be delighted to discuss your project with you and answer all your questions.

Ampelio brings over 10 years of experience in supporting and advising on wine estate transactions in the Loire Valley.