French Vineyard Prices : What You Need to Know in 2025

Table of contents

- Who Sets Vineyard Prices? How Are Vineyard Prices Determined?

- Vineyard Prices in France

- Summary Table of Vineyard Prices by Region in France (2025)

- Vineyard Prices in the Loire Valley

- Outlook: Toward an Increase or Stabilization of Vineyard Prices in the Loire?

- Our Advice for Investing in Vineyards

- Conclusion

Summarise this article with :

Vineyard prices in France depend on multiple criteria.

There is an official price listing published by Agreste or SAFER, which provides an indication based on wine-growing regions. However, this database can only be refined through a comprehensive analysis of the specific appellation, the condition of the vines, their age, the grape variety planted, and the yields obtained.

Combined, these elements make it possible to estimate the value of a vineyard.

Vines are living organisms, in constant evolution. Each plot reflects the daily work and passion of the winegrower. This is why two vineyards located only a few kilometers apart can display very different values, depending on their terroir, their classification under an AOP, their orientation, and their production potential.

Since 2012, Ampelio has been supporting winegrowers in the Val de Loire in showcasing the value of their vineyards, helping them defend a fair price through the analysis of economic, technical, and human data.

In this article, we invite you to explore a detailed overview of the mechanisms behind vineyard valuation, as well as a unique vision of the French vineyard land market in 2025.

Who Sets Vineyard Prices? How Are Vineyard Prices Determined?

The price of vineyards results from a cross-analysis of information and trends in the land market. Today, in France, these prices are set by Agreste, the SAFERs, and viticultural experts.

Agreste & SAFER: Official Listings

Agreste is a public statistical service responsible for collecting, producing, analyzing, and disseminating data related to French agriculture, forestry, and agri-food industries. It operates under the authority of the Direction des Affaires Financières et de la Logistique (DAFL), with support from the Service de la Statistique et de la Prospective (SSP).

SAFER (Sociétés d’Aménagement Foncier et d’Établissement Rural) are public organizations whose mission is to regulate the rural land market to serve the public interest. Their main objectives include preserving agricultural land, protecting natural environments, preventing land speculation and supporting the balanced growth of rural regions.

The price of vineyard land is established each year by the Agreste and SAFER networks, following a method defined in 2009. This calculation is based on a grouping of wine appellations, in accordance with Decree No. 2008-1359 relating to the conseils de bassins viticoles.

- For most regions (excluding Alsace and Champagne), the reference prices (dominant, minimum, and maximum) are set “à dire d’expert”—that is, based on field observation and expert assessment.

- In Alsace and Champagne, the average price is calculated statistically, then validated à dire d’expert, with outlier values removed.

The annual average prices per department and per winegrowing basin are then obtained by a weighted aggregation of the prices of the different appellations, according to their planted surface area (data drawn from the computerized vineyard register – CVI).

Viticultural Experts: A Tailor-Made Assessment

Beyond official references, the valuation of a wine estate requires a personalized analysis carried out by professionals:

- Land and agricultural experts

They are mandated to assess vineyard value. Their expertise is based on technical analysis (age of vines, grape variety, yield, phytosanitary condition), economic performance (profitability, charges), and legal context (leases, planting rights).

- Specialized agencies

With in-depth knowledge of the local market, specialized firms provide a unique perspective on the value of vineyard land. Thanks to their strong regional presence, they offer accurate assessments that take into account recent transactions, vineyard attractiveness, and market potential.

For over 13 years, Ampelio has been assisting winegrowers and buyers with valuation projects, integrating technical, economic, and human dimensions specific to each estate.

- Notaries

They ensure legal transparency by overseeing vineyard transfers. Their role is to secure the legal aspects of sales and guarantee compliance with property rights.

Vineyard Prices in France

France is home to 14 major winegrowing regions: Alsace-Lorraine, Armagnac and Cognac, Beaujolais and Lyonnais, Bordeaux, Bourgogne, Champagne, Corsica, Jura, Languedoc-Roussillon, Provence, Savoie, the South-West, the Loire Valley, and the Rhône Valley.

According to Le Figaro Vin, vineyard prices fell in 2024. The average price of one hectare of vines now stands at €176,400, representing a decrease of 1.1% compared with the previous year.

This national average, however, conceals very sharp contrasts between regions.

The figures presented below are based on price listings published by Agreste and SAFER. For more detailed information, you may refer to the full Agreste and SAFER reports

Summary Table of Vineyard Prices by Region in France (2025)

| Wine Region | Price Range (€/ha) | Observations |

|---|---|---|

| Loire Valley | €5,000 – €215,000 | Very diverse, strong potential |

| Rhône Valley | €14,000 – €510,000 (Châteauneuf-du-Pape) – €1,250,000 (Côte-Rôtie) | Heterogeneous North/South |

| South-West | €9,000 – €15,000 (Madiran, Saint-Mont…) | Affordable market |

| Savoie | €21,000 – €50,000 (+13% in Quatre Cantons) | Stable, discreet market |

| Provence | €45,000 – €125,000 | Very attractive, strong demand |

| Languedoc – Roussillon | €8,000 – €33,000 (Picpoul) – €75,000 (Pic Saint-Loup) | General decline except top crus |

| Jura | €35,000 – €55,000 | Continuous price increase |

| Corse | €16,000 – €35,000 | Growing interest |

| Champagne | €930,000 – €1,680,000 | Safe haven – highly dynamic market |

| Bourgogne | €35,000 (generic Bourgogne) – €7,000,000 (Grand Cru) | Strong market pressure |

| Bordeaux – Aquitaine | €9,000 (AOP Bordeaux) – €270,000 (Saint-Émilion) – €3,000,000 (Pauillac) | Spectacular disparities |

| Beaujolais – Lyonnais | €11,000 (Beaujolais) – €100,000 (Moulin-à-Vent) | Rising attractiveness of crus |

| Armagnac – Cognac | €35,000 – €65,000 | Decline due to reduced exports |

| Alsace – Lorraine | €90,000 – €138,000 (Alsace) / No data available (Lorraine) | Positive dynamics |

Alsace – Lorraine

The vineyard market in Alsace remains stable, with a slight increase in prices driven by the revival of Pinot Noir and sustainable practices. Vineyards are negotiated between €90,000/ha in the Bas-Rhin and €138,000/ha in the Haut-Rhin.

The Lorraine vineyard remains very marginal in both surface area and volume within the French vineyard market: only 180 hectares (AOC Moselle and Côtes de Toul, as well as IGP Côtes de Meuse). To date, it has not been the subject of any significant land studies, as transaction volumes are very limited.

Armagnac et Cognac

Overall, the vineyard market for eaux-de-vie, driven by Cognac, experienced a clear slowdown starting in 2023. After several years of growth, prices have declined due to a drop in exports, particularly to the United States.

That said, the sector remains well structured, with strong regulation and sustained attractiveness for the highest-quality crus.

Prices range between €35,000/ha and €65,000/ha, depending on the cru.

Beaujolais et Lyonnais

Beaujolais is regaining attractiveness thanks to the renewed prestige of its crus and refreshed communication. The vineyard, however, remains fragmented, which can sometimes hinder vineyard transfers.

The Beaujolais appellation is currently valued at around €11,000/ha, while the crus exceed €60,000/ha. The renowned Moulin-à-Vent cru reaches up to €100,000/ha.

Bordeaux-Aquitaine

The Bordeaux vineyard market shows spectacular price disparities depending on the reputation of the appellations. While the generic AOPs are suffering heavily from a crisis linked to overproduction and declining red wine consumption, the great prestigious appellations are maintaining very high price levels.

A few examples illustrate this gap: €9,000/ha for an AOP Bordeaux, €15,000/ha for Monbazillac, €21,000/ha for Fronsac, or €25,000/ha for the Médoc.

Prestigious crus reach staggering heights: €270,000/ha in Saint-Émilion, €1.5M/ha in Margaux, €2M/ha in Pomerol, and up to €3M/ha in Pauillac.

Bourgogne

Bourgogne remains a wine region in high demand, both in France and internationally. The rarity of vineyard transfers makes the market particularly tight, and price benchmarks are difficult to generalize.

Nevertheless, price levels show sharp contrasts depending on the terroir: around €35,000/ha for a Bourgogne appellation, an average of €200,000/ha for Chablis, and up to €420,000/ha in the Côte de Beaune.

At the very top end, Bourgogne Grands Crus exceed €7 million/ha.

Champagne

Champagne continues to embody a safe haven within the French vineyard land market. Despite a slowdown in exports, prices remain on an upward trend. Limited available surface area, combined with Champagne’s strong international reputation, sustains the value of vineyards—particularly within the classified crus.

Thus, AOP Champagne vineyards are estimated at around €930,000/ha, rising to €1,680,000/ha for the Grands Crus.

Corse

The Corsican vineyard remains limited in size, but it is attracting growing interest, notably due to its positioning and diversity of terroirs. While the volume of transactions is still low, the qualitative momentum is real, driven by a new generation of winegrowers.

Prices remain relatively accessible: Corsican vineyards range from €16,000/ha (outside AOP) up to €35,000/ha for the Patrimonio and Coteaux du Cap appellations.

Jura

The Jura is experiencing renewed interest, thanks to the growing reputation of its white wines and the recognition of its terroirs. This small region is increasingly attractive, which continues to drive prices upward.

The price of one hectare of vineyards ranges between €35,000 and €55,000/ha.

Languedoc – Roussillon

Languedoc-Roussillon is going through a difficult period, marked by a decline in red wine consumption and strong economic pressure on winegrowers. Vineyard prices are slightly retreating in most appellations, with the exception of a few terroirs that stand out thanks to strong qualitative positioning.

Most Languedoc appellations—such as Minervois, Muscat, Faugères, or Corbières—show reasonable prices, around €8,000 to €15,000/ha. In contrast, certain AOPs such as Picpoul de Pinet and Pic Saint-Loup reach €33,000/ha and €75,000/ha respectively. Vineyards in the Banyuls or Collioure appellations, highly sought after for their unique geographic features, reach around €21,000/ha.

Provence

The Provençal vineyard market is among the most attractive in France, driven by strong international demand for premium rosés and the prestige of certain appellations. Its image, combined with the scarcity of vineyard land, supports high and stable price levels.

AOP Bandol vineyards reach €125,000/ha, while those in the Côtes de Provence average around €60,000/ha. Other appellations, such as Les Baux-de-Provence (€45,000/ha) or Cassis (up to €120,000/ha), confirm the strong valuation of the Provençal vineyard.

Savoie

The Savoyard vineyard market is discreet but stable, supported by strong local consumption and qualitative projects often linked to mountain tourism.

In 2024, vineyard prices vary by appellation: between €21,000/ha in Chautagne and €50,000/ha in the Cluse de Chambéry. The Quatre Cantons sector stands out with a marked increase, reaching €27,000/ha (+13%).

South-West

The vineyard market in the South-West displays great diversity but overall remains slightly below the French average. The decline in red wine consumption affects the region, particularly its lesser-known appellations.

However, certain areas stand out thanks to their distinctive identity and strong attachment to terroir.

Vineyards in the Cahors appellation trade around €13,500/ha, those in Madiran at €15,000/ha, and Gaillac at about €9,000/ha. AOPs such as Pacherenc du Vic-Bilh or Saint-Mont show similar prices, between €14,000 and €15,000/ha.

Rhône Valley

The Rhône Valley offers a highly heterogeneous vineyard market, where prestigious appellations coexist with struggling areas. The northern sector (Saint-Joseph, Côte-Rôtie, Hermitage…) benefits from strong renown and high valuation.

By contrast, the southern part of the valley—particularly the generic appellations such as Côtes-du-Rhône—is suffering from the crisis in red wine consumption.

This dichotomy is reflected in transactions: crus are holding steady, or even rising, while regional appellations are seeing their prices erode.

In 2024, AOP Côte-Rôtie and Condrieu vineyards reach record levels at €1.25M/ha. In Saint-Joseph, prices are rising significantly, averaging around €140,000/ha (+17%). Châteauneuf-du-Pape, still in very high demand, continues its upward trend, surpassing €510,000/ha.

Conversely, regional Côtes-du-Rhône vineyards in the Drôme or Gard have dropped to €14,000–15,000/ha.

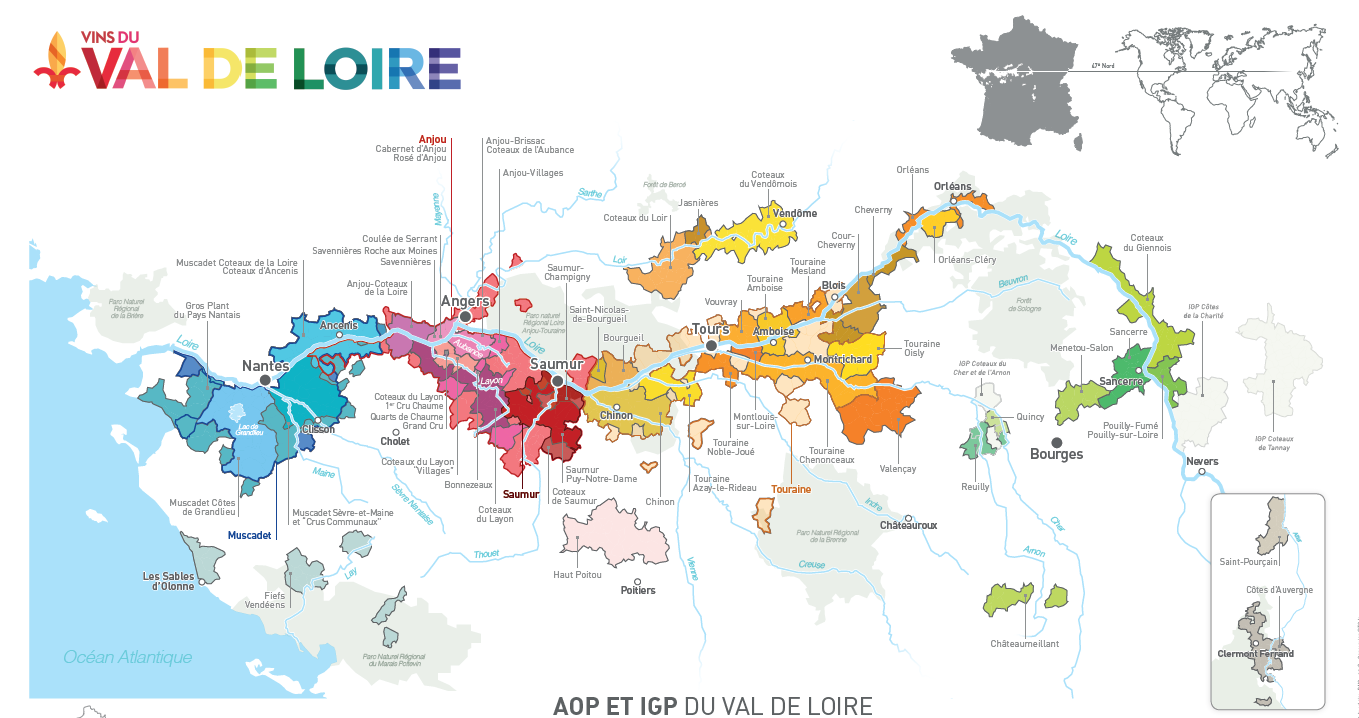

Vineyard Prices in the Loire Valley

The Loire Valley, the largest winegrowing region in France, stands out for the richness and diversity of its terroirs. Its current dynamism and the growing reputation of its appellations make it a particularly attractive territory for acquisition projects.

Browse Our Vineyards for Sale in the Loire Valley

Muscadet

Vineyard prices vary by sector, generally ranging between €5,000 and €16,000/ha, with higher valuations in the most qualitative crus communaux.

Anjou

The diversity of appellations results in a wide price range. AOP Anjou vineyards average around €19,000/ha, while sweet whites, particularly Coteaux du Layon, reach between €20,000 and €120,000/ha, peaking for parcels classified as Grand Cru Quarts de Chaume. The Savennières appellation, renowned for its age-worthy dry whites, can exceed €70,000/ha.

Saumur

Prices have risen significantly in recent years, with vineyards now trading between €30,000 and €70,000/ha (for Saumur Champigny).

Chinon, Bourgueil, Saint Nicolas de Bourgueil

These areas remain accessible, with values ranging from €15,000 to €50,000/ha, depending on location and soil quality.

Vouvray, Montlouis

The growing enthusiasm for Chenin, the region’s emblematic grape, supports prices, which now range between €15,000 and €25,000/ha, still offering excellent value for money.

Touraine

The less highly valued appellations average around €10,000/ha, representing an opportunity for development projects.

Centre Loire

Valuations rise sharply here. Quincy, Reuilly, and Menetou-Salon stand between €60,000 and €90,000/ha. Pouilly-Fumé vineyards reach €160,000/ha, while Sancerre, boosted by its international renown, records exceptional levels at around €215,000/ha. However, the scarcity of transactions in this area means references are less frequent, and values may vary significantly depending on supply and demand at the time

Outlook: Toward an Increase or Stabilization of Vineyard Prices in the Loire?

It is always complex to forecast the future of something as evolving as vineyards and nature.

That said, we are observing a growing interest in the Loire Valley—from young winegrowers establishing themselves, career changers, investors, and even French vignerons seeking diversification.

This region attracts with the freshness of its wines, the rising consumer demand for lighter, more approachable styles, and a cultural heritage that lends itself to wine tourism.

The Loire Valley also benefits from an exceptional diversity of terroirs and grape varieties, a widely recognized quality of life, and a climate that remains only moderately impacted by global warming.

From an economic standpoint, its vineyard land prices—still accessible compared to other French winegrowing regions—make it a land of opportunity for new ventures and diversification projects.

This context favors a gradual rise in prices within the most sought-after appellations (Sancerre, Saumur, Vouvray…), while other appellations tend to stabilize, offering opportunities for ambitious projects.

Accessible and resilient, the Loire Valley thus establishes itself as a region of the future, combining economic potential with quality of life for winegrowers.

Discover the Advantages and Opportunities of a Vineyard Estate in the Loire Valley

Our Advice for Investing in Vineyards

1. Define Your Objectives

Before investing, clearly define the nature of your project: is it about starting a new vineyard, a professional reconversion, or an investment focused on vineyard profitability? Each profile requires a different financial and human commitment.

2. Choose the Right Region

The choice of winegrowing area depends on your budget, your affinities with certain wine styles, and the dynamism of the local market. Some regions, such as the Loire Valley, offer a good balance between accessible land prices, vibrant appellations, and strong potential for value creation. In contrast, already highly rated regions (Bourgogne, Champagne) require greater capital but may offer higher returns.

3. Analyze Economic Indicators

Study land prices, market trends, operating costs, and commercial opportunities. A solid understanding of these factors will allow you to evaluate your medium- and long-term vision, depending on the appellation, yields, and distribution channels.

4. Work with Industry Professionals

Relying on a vineyard transaction expert—such as Ampelio—helps streamline every stage: identifying estates that match your profile and project, valuation, land audit, negotiation, legal and financial guidance.

Discover which advisors you should rely on during a vineyard transfer.

6. Build a Business Forecast

Whether it is the takeover of an estate or a financial investment, assess the technical and economic viability: vineyard condition, equipment, workforce, compliance with standards, production potential… These are key elements for estimating profitability thresholds and return on investment..

7. Adopt the Right Legal Structure

Depending on your objectives, you may invest through a farming company (EARL, SCEA…), a Groupement Foncier Viticole (GFV), or as an individual owner. The chosen legal framework will have a direct impact on your activity.

Conclusion

A vineyard is not just a piece of land: it is a living universe, a winegrowing enterprise in constant evolution, deeply connected to the cycles of nature and the work of the vigneron. Each plot carries a history, a terroir, and the hand that tends it season after season.

The vineyard is never static. It evolves with the climate, viticultural practices, generations, and human choices.

This is why it is essential to assess and value each vineyard in its entirety, at a given moment, with precision and expertise.

At Ampelio, we believe that this detailed, tailor-made approach is the key to a successful investment. Our mission is to support project leaders—whether sellers or buyers—with a realistic, committed, and insightful vision of the vineyard market.

At Ampelio, our mission is to create the right match between a wine estate and its future owner. We place people at the very heart of our work.

In every transfer, our main concern is ensuring that the association is lasting, sustainable, and balanced — so that each party can thrive and find value in the project. The economic future of the wine estate is also a key element we take into account.

We actively support these transitions and dedicate all our expertise to serving each project.

Do you have a question about selling or buying a wine estate?

Our team will be delighted to discuss your project with you and answer all your questions.

Ampelio brings over 10 years of experience in supporting and advising on wine estate transactions in the Loire Valley.